Lowest Prices In The Industry

Or keep feeding inflation and Wall Street. It’s your a$$‑et.

No salespeople. No chase. Just Gold & Silver IRAs at 5% over our cost since 2012.

15,000+ Clients Trust Us Since 2012

Claim Your Free Guide: Protect Your Retirement Now

Learn how precious metals can safeguard your retirement. Fill out the form to receive your complimentary guide.

What Is A Precious Metals IRA?

A Precious Metals IRA is a specialized self-directed IRA that empowers investors to diversify their retirement portfolio by holding physical precious metals. This type of individual retirement account allows you to invest in IRS-approved gold, silver, platinum, and palladium bullion and coins.

Unlike traditional IRAs, a Precious Metals IRA offers direct ownership of tangible assets, providing a unique wealth preservation strategy.

It's an excellent tool for portfolio diversification, helping to safeguard your savings against market volatility and inflation. By investing in gold IRA, silver IRA, platinum IRA, or palladium IRA, you can leverage the intrinsic value of these metals to protect and grow your retirement wealth.

Why Choose Us?

Learn How To Preserve your Wealth.

While we are not financial advisors, we can give you a portfolio evaluation, help calculate your susceptibility threshold and make our educated recommendations.

Fight Against Inflation

Develop a strategy to preserve your wealth and outpace inflation.

Market Loss Mitigation

We build a resilient goldsilver portfolio to help mitigate market losses.

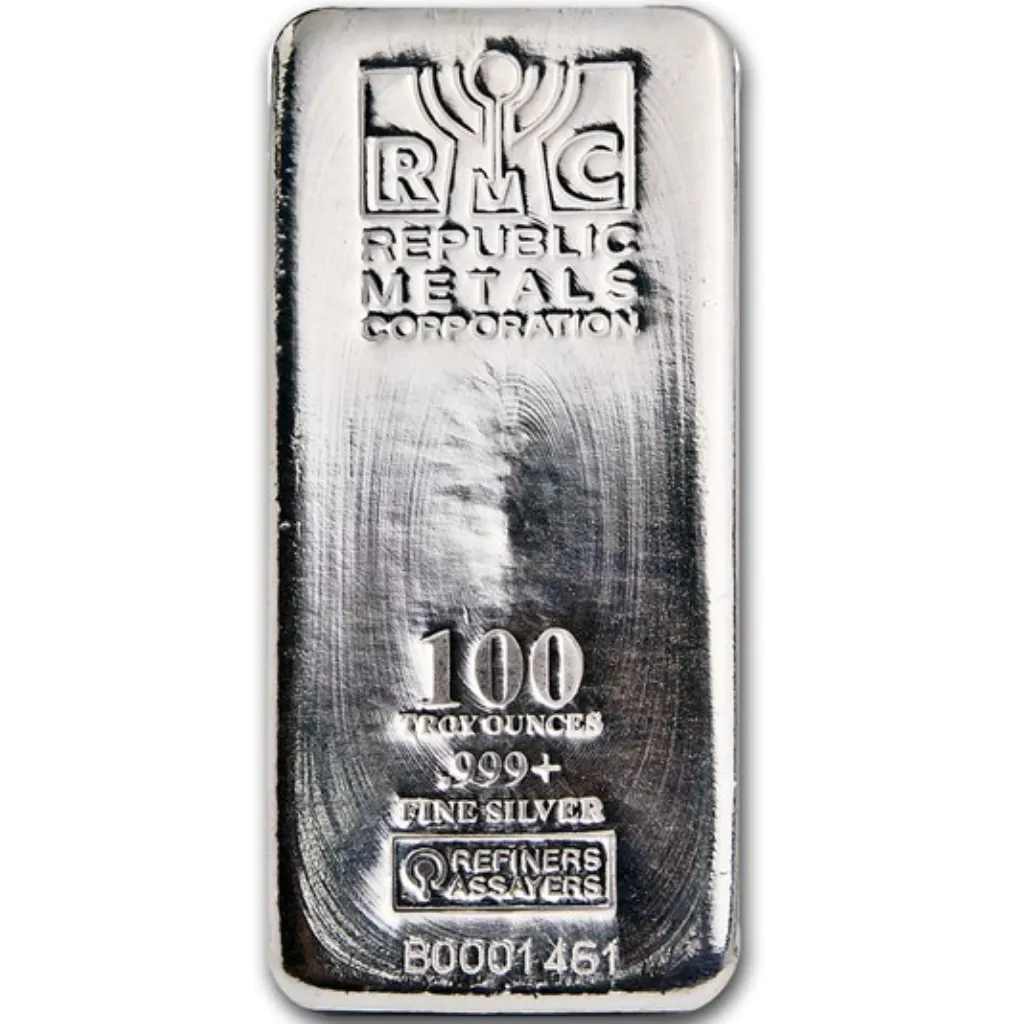

Eligible Bars

What We Do

How a Precious Metals IRA Rollover Works.

Opening a Precious Metals IRA allows you to use physical gold, silver, and other metals to preserve the value of the money you’ve spent your entire life saving. It’s a tax-deferred way to add long-term growth and stability to your retirement strategy.

Step 1 – Allocate Funds

1. Decide How Much to Protect.

On a brief call, we look at your current 401(k)/IRA, your age, and decide what portion makes

sense to move into metals. You’re in control. No pressure.

Step 2 – Paperwork

2. We Handle the Heavy Paperwork.

We coordinate with an IRS‑approved custodian to open your self‑directed IRA and request the rollover/transfer. Typical completion time: 4 - 6 weeks, depending on your current custodian.

Step 3 – Delivery & Storage

. We Handle the Heavy Paperwork.

We coordinate with an IRS‑approved custodian to open your self‑directed IRA and request the rollover/transfer. Typical completion time: 4 - 6 weeks, depending on your current custodian.

Step 4 – Confirmations

4. Delivery Confirmation

Once your metals are securely delivered to an insured depository account in your name (tracking numbers provided to you prior to delivery), you will receive final delivery confirmations and ongoing statements. You can also track on your own.

Benefits of Precious Metals IRAs

Our silver IRA benefits are designed for those tired of watching their savings lose value to inflation and market uncertainty. By adding physical silver to your retirement plan, you gain a proven way to preserve your wealth, reduce risk, and build a more secure financial future with confidence.

Insurance

401(k) Gold Group makes your plan safe. Precious metals is insurance against loss of equity in a retirement account.

Inflation Hedge

Gold and silver can serve as a hedge against inflation and currency debasement in a retirement account. Check the % growth.

Constant Value

The value of all fiat currencies is predicated on the constant value of gold. The dollar has lost most of its value and is dying.

Profitability

Gold and silver provide competitive returns compared to other major financial assets.

Lowest Fees

We are very transparent. We save you thousands of dollars in fees with physical gold and other precious metals.

Risk Diversifier

Gold and silver act as diversifiers and a vehicle to mitigate losses in times of market stress.

Testimonials

Jim McKinzie

C.E.O.

ATM Designing Company, Wyoming – “I have worked with 401(k) Gold Group for many years. During that time, they have guided me with only my best interests in mind. I have never been subjected to “bullying” tactics or high-pressure sales that has made me uncomfortable. If it is not a good time to invest, they have honestly told me so. They have also kept in contact and has given me updates every quarter. Being self employed, my investments need to be as solid a possible. I can trust the knowledge and integrity that 401(k) Gold Group has shown me”.

Cover your Ass-ets. Fight Inflation with our gold iRAs.

You’ve seen what inflation and fees are doing to your account.

A 15‑minute call shows you where you stand and how gold can help.

Disclaimer:

401(k) Gold Group, Inc. does not provide investment or tax advice. Precious metals are speculative purchases and involve substantial risks. Past performance is no indication or guarantee of future performance or returns. A minimum purchase applies. Market prices are volatile and unpredictable and may rise and fall over time. Before making a purchase, you should consult your advisors.